Given this trend, you might be thinking: how do you automate accounting? Let’s break it down.

If you are planning to automate the business, start by reviewing the current process and identifying the right technology, documenting workflows, implementing automation tools, and other aspects.

This article will explore accounting automation, its benefits, potential challenges, and the exact steps to automate your financial operations effectively. Keep reading to learn how to get started.

What Is Accounting Process Automation?

Accounting process automation (APA) is a software technology automation process that is used to perform various finance and accounting tasks. It is now a system that many companies are starting to use to do away with the traditional manual accounting processes, which are based on spreadsheets and require human handoffs that are less efficient and precise.

Overview of Accounting Process Automation

Accounting automation covers expense management, supplier invoicing, financial reporting, and financial activities. If routine processes rarely require any intervention, APA will automate the transfer of data and information rather than enter it manually through different systems.

Accounts payable is a vital finance function that determines how and when a company pays its suppliers. Managing payments can become complex as a company grows. If a glitch occurs, it could delay payments or even cause missed payments, potentially damaging relationships with vendors. APA, on the other hand, creates an integrated digital workflow for the entire accounting workstream that eliminates manual work, while RPA uses software bots to handle repetitive tasks such as invoice processing.

Advantages of Accounting Process Automation

There are many advantages to using APA, one of which is that it enables faster and more accurate work. Explore further to discover the extended benefits of APA:

- Time savings: Automating accounting saves a lot of time! Not long ago, finance professionals were required to manually check and duplicate tons of data in various systems to carry out tasks like bank reconciliation and quarterly reporting. This was one of the most unproductive and highly error-prone operations. APA automates the verification and transfer of accounting data, relieving finance teams from routine tasks to work on higher-value activities.

- Decreased operating expenses: Accounting tasks are completed faster, and fewer people are needed to do them, making the process more cost-effective when automated. One area where automation is especially beneficial is invoicing, as it helps reduce costs and improve productivity.

- Improved Data Accuracy and Consistency: Manual data entry errors are common as businesses grow with ever more complicated accounting needs. APA solves this problem by automating the recording, updating, and transferring of numerous data points so the information is accurate and reliable.

- Easier access to data: APA presents all accounting data in one central place, so you don’t need to waste time searching through physical documents or spreadsheets. By simply typing search terms into the software, finance professionals can quickly find the necessary data and make informed decisions.

- Simplified approval processes for documents: APA speeds up approvals by simply uploading documents like purchase orders and supplier contracts to a central system that all stakeholders can access, eliminating the hassle of the approval process and delays.

- Strengthened business partnerships: Timely and accurate processing of invoices and payments is key to good relationships with customers and suppliers. APA optimizes the entire procure-to-pay process so everyone is happy.

- Guaranteed compliance and governance: APA software can generate tax returns, create financial statements, and update tax documents in line with regional regulations. This improves accuracy and compliance and streamlines operations. It also reduces the workload on the accounting team for compliance monitoring and improves governance through better data visibility and integrity.

Disadvantages of Accounting Process Automation

While the APA offers many benefits, it also brings challenges when people don’t use it right. Here are some downsides to think about:

- Employee Skills Enhancement: Employees need to get comfortable with new software to use APA, which isn’t always easy. Not everyone on the team may be tech-savvy, so good training and a little patience go a long way in helping everyone adapt.

- Workflow Modifications: People need to plan and test automated workflows to avoid creating new problems or mistakes. It’s important to check and improve APA processes before using them widely because an adapted workflow can cause big issues.

- Managing Change: Accounting teams may resist new automated processes because people naturally dislike change. So, it is important to show the employees how APA makes their work easier and better to gain their support.

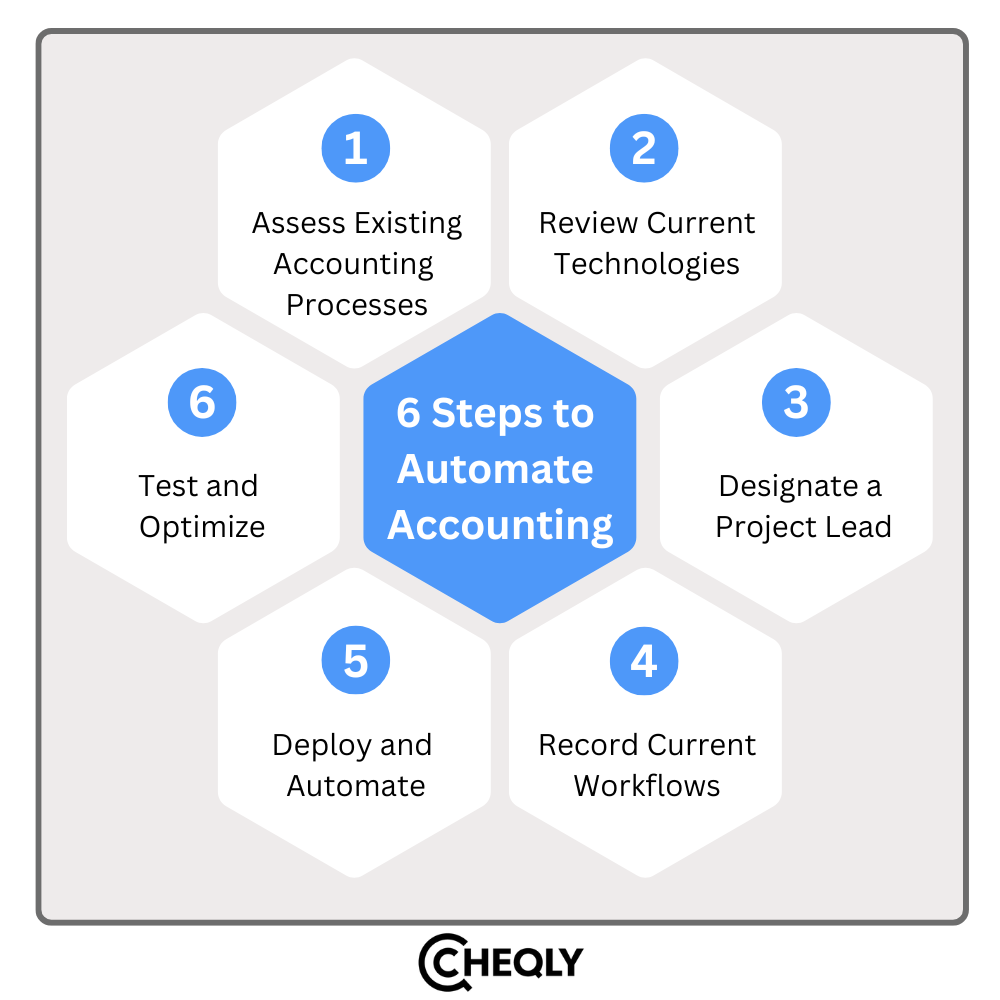

Six Steps for Accounting Process Automation

The automation of accounting processes necessitates a methodical and deliberate approach. To initiate the process, follow these steps:

Assess Existing Accounting Processes

Find tasks that are repetitive and don’t need much human decision-making or creativity—those are the best ones to automate.

Review Current Technologies

Afterward, the first thing you need to do is identify processes that can be automated. Then, look into the best tools for the job. If your accounting software is outdated and your team still depends on spreadsheets, it might be time for an upgrade to a system that can handle invoices, data entry, and reports. And if your business is growing fast, a cloud-based APA service can keep up and provide real-time insights.

Designate a Project Lead

Have a project lead on the team to oversee the entire operation and setup of the automated workflows. An expert will help guide you and ensure the flow of operations while solving any complications that arise.

Record Current Workflows

Current workflows should be studied in order to identify spots that should be improved. This will help you build more efficient automated processes that serve your business needs.

Deploy and Automate

To automate workflows, define triggers, actions, and outcomes for each process. For instance, submitting a new purchase order (PO) in a purchase order workflow could trigger an automatic email to the appropriate approver.

Test and Optimize

Testing will verify that the automated workflows produce the correct result. Continue for as many cycles as needed to optimize accuracy and efficiency.

7 Accounting Tasks You Can Automate Right Now

Each organization is at a distinct stage in its automation journey. Some may opt to automate multiple processes simultaneously, while others may begin by automating a single task.

- Accounts Payable: The automation of accounts payable (AP) simplifies payment procedures, ensures that vendors pay invoices on time, and simplifies invoice tracking. Fraud is minimized by APA’s ability to identify and flag suspicious invoices.

- Accounts Receivable: Accounts receivable (AR) automation improves invoice accuracy, reduces processing costs, and improves cash flow management. This can be implemented not just for invoicing but for all aspects of accounts receivable, e.g., collecting payments in case of overdue accounts.

- Payroll: Manual payroll processing can be a very time-consuming task, especially for a growing company. By automating payroll, employers ensure that employees are paid on time and that all significant payroll forms are filed accurately and on schedule.

- End-of-Month Financial Closures: The month-end closure process for finance teams can be stressful. With automation, these teams can deliver the results without compromising quality. Its feature also checks the data and expedites the closing process.

- Procurement: Buying things for a business involves many people and a lot of paperwork. Automating tasks like managing purchase orders saves time and money, keeps things fair, and helps you work well with suppliers.

- Expenditure Reports: When expense reports are automated, employees don’t need to submit and approve them manually. Accounting can approve more expenses submitted online, reducing office work.

- Order Processing for Sales: Using automation, you can ensure your sales orders are on time, keeping your focus on making customers happy and satisfied. This improves company operations and enhances customer satisfaction.

To sum up, using automation in accounting helps reduce errors and saves time, but it’s not instant. Take it one step at a time—check your system, pick the right software, and keep improving. In the long run, it will make invoicing, payroll, and expense tracking a lot easier. Setting up new processes and training your team might be a bit tricky, but it’s totally worth it.

FAQs on Automating Accounting Processes

Find answers to common questions about automating accounting processes.

How do I choose the right accounting automation software?

Choose a software that’s straightforward, integrates well, is within budget, comes with strong support, and is built to scale.

How often should I check and improve my automated accounting processes?

Automation workflows should be reviewed regularly to prevent errors, ensure efficiency, and update systems as the business grows.

What challenges might arise during automation?

Common difficulties, such as employee resistance, integration issues, and initial implementation costs, are often experienced. One way to make the transition to a new system smoother is to provide proper training and support.

How can I measure the success of accounting automation?

To assess the success of automation processes, evaluate time savings, increased efficiency, and reduced errors.

Keep Your Business Finances Organized with Cheqly

Small business owners need to track expenses and make timely payments, which can be challenging. Cheqly’s neobanking tools help manage money more easily and keep everything organized.

Take charge of your finances—sign up with Cheqly now!