The management of a small business requires more than just a brilliant product or service; it also takes business financial discipline and strategic planning in order to realize the financial stability of the business. Unbelievably, almost 60% of small businesses struggle to manage their cash flow, and as a result, potential growth often fails when small business owners become poor financial managers. Most of them fail not due to the unavailability of revenue but due to the non-existence of business financial management practices, such as business expense management and finance targeting.

Good financial behavior among small business owners brings business financial strength, which enables them to make informed choices and survive the challenges. In this article, we will discuss the 10 financial habits for small business owners with some actionable tips. Let’s get started.

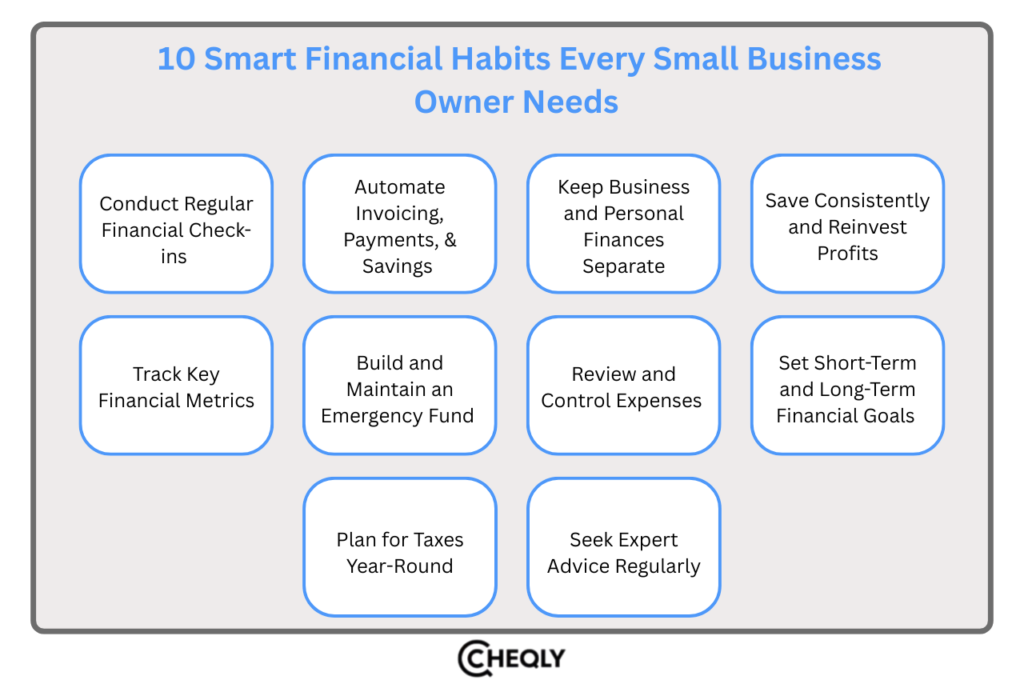

10 Smart Financial Habits Every Small Business Owner Needs

Learning these financial habits by small business owners is the secret to business financial stability and growth. All the habits are cash flow management, business expenses, and financial planning of small businesses to create profits.

Conduct Regular Financial Check-ins

Frequent financial check-ins ensure your business’s financial management is in great shape by reviewing accounts, invoices, pending payments, and expenses on a daily, weekly, or biweekly basis. Keeping this habit makes your cash flow clear to you, allows you to spot mistakes at an earliest stage, and stops you from overspending or running into financial problems that are not clear at first.

Actionable tips:

- Schedule daily/weekly short 15-20 min focused sessions to reconcile accounts and check for pending invoices.

- Take a look at the recent transactions and sort them in your spreadsheet or accounting software.

Automate Invoicing, Payments, and Savings

Automation is making repetitive financial tasks such as sending invoices, paying the same bills repeatedly, and saving a portion of revenue much easier. This is a financial practice that helps small business owners collect on time, implement small business savings strategies, and spend time on growth.

Actionable tips:

- Establish invoicing that automatically sends out reminders and keeps records of late payments.

- Recurring payment rules for vendor bills can be created to prevent manual processing from month to month.

- Set up automatic transfers from your revenues of a certain percentage, such as 10%, to a separate savings account.

Keep Business and Personal Finances Separate

Business expense tracking and tax payments are made transparent simply by differentiating business and personal finances through separate accounts and cards. Mixing them up will confuse your financial metrics, make tax filing more difficult, and put your business’s financial health at risk.

Actionable tips:

- Conduct operations and handle revenue through a dedicated business bank account only.

- For easier financial planning and audit, you can use distinct business credit cards.

- Taking periodic owner’s draws for personal needs is the right way to do it; never use business funds directly.

Save Consistently and Reinvest Profits

Saving regularly and reinvesting the profits of the business back into it helps the business grow and become financially stable. This provides a financial buffer for unexpected needs, promotes planning for the future, and allows the business to invest in goods, expansion, or marketing without borrowing.

Actionable tips:

- Each month, set aside a predetermined small percentage (5–10%) of revenue in a high-yield savings account.

- Set aside 20–30% of the profits for purchasing new equipment, marketing, or expanding the business.

- Review savings and reinvestments on a quarterly basis to make sure they are in line with the business goals.

Track Key Financial Metrics

Tracking financial indicators such as cash flow, profit margins, net profit, receivables, and expense ratios reveals areas of underperformance in business financial management. Constant monitoring leads to evidence-based financial planning of small businesses.

Actionable tips:

- Measure the performance of key metrics monthly using accounting tools.

- Create charts to visually represent cash flow and operating cost trends.

- Revise plans for cost-cutting or revenue-enhancement following insights.

Build and Maintain an Emergency Fund

An emergency fund is a separate pool of money set aside to cover unexpected expenses such as equipment breakdown, sudden loss in sales, or unexpected operational costs. It enables your business to keep running normally and lessens the need for taking out high-interest loans or credit when facing difficulties.

Actionable tips:

- Include your monthly operating expenses (like rent, payroll, utilities, etc.) in the calculation.

- Have a goal of setting aside 3–6 months’ worth in a separate business savings account.

- Make a contribution regularly (e.g., 10% of monthly profits) until the entire amount is funded.

Review and Control Expenses

Regular scrutiny of expenses is essential in curbing unnecessary spending and boosting profit by identifying waste in different areas, e.g., product operations, subscriptions, and administration. Moreover, it ensures that resources are appropriately aligned with the growth of the business.

Actionable tips:

- Sort and revise all expenses to identify those that can be cut or renegotiated.

- Terminate idle subscriptions and compare them against industry fiscal benchmarks.

- Automate approvals to enhance cash flow and revenue management.

Set Short-Term and Long-Term Financial Goals

Setting clear financial goals is like giving your business a map with instructions to follow. Short-term goals are related to tracking cash flow and the daily operations of the business. On the other hand, long-term goals are concerned with expansion and taking advantage of the strategy, thus reducing costs and attaining real and measurable outcomes.

Actionable tips:

- Create SMART goals such as “Increase profits by 10% this quarter.”

- Review goal progress each month and make adjustments to the goals annually.

- Keep an eye on expenditure in relation to the short-term cash flow targets.

Plan for Taxes Year-Round

Engaging in tax planning throughout the year is an effective way to make your life less stressful, ensure compliance, and improve cash flow by identifying deductions that are available to you and setting aside money for tax payments. This also allows business owners to get the most out of tax benefits and strategically reinvest.

Actionable tips:

- Make monthly deposits of 20-30% of income into a dedicated tax savings account.

- Utilize accounting software for tracking, recording, and reporting deductible operational expenses on a monthly basis.

- Meet with a financial advisor for a small business quarterly to make sure you’re compliant and to save on taxes.

Seek Expert Advice Regularly

Talking to accountants, financial advisors, or mentors is a great way for business owners to become financially savvy. Besides helping you dodge errors that can be very expensive, they can also provide risk management, tax planning, and counseling, and spot growth avenues that will make your whole business strategy more robust in a way you can easily grasp.

Actionable tips:

- Schedule a quarterly meeting with the most trustworthy advisors during which you can review your finances and discuss your business strategy.

- Distribute cash flow and profitability reports to identify areas for improvement.

- Establish a small advisory board to bring in a mix of financial viewpoints.

FAQs: Financial Habits for Small Business Success

The following are some frequently asked questions about business financial habits for success.

Can small businesses use KPIs to shape financial behavior?

Yes, owners of small businesses can use financial KPIs such as profit margins and cash flow metrics to encourage disciplined expense tracking and efficient revenue management.

How can small businesses identify financial inefficiencies?

Audit operational expenses monthly via business expense tracking tools to spot and cut waste.

How does profit allocation affect business growth?

Profit allocation influences growth by determining the portion of profit that is used for reinvestment in business expansion and the portion that is retained as reserves. Reinvesting is the main source of growth, whereas reserves back up stability.

Can strong financial habits improve supplier relationships?

Strong financial habits support supplier relationships through timely cash flow management and trust development, which can lead to getting better terms.

How can founders use financial metrics to improve pricing strategies?

Founders may leverage financial metrics like revenue and cost data to improve their pricing strategies and thereby enhance their profit margins.

How can small businesses build a culture of financial responsibility?

Small businesses can build a culture of financial responsibility by training teams on financial goal setting, expense tracking, and regular check-ins.

Build Strong Financial Habits With the Right Partner

Cheqly supports you in establishing healthy financial habits alongside working on your business growth. By using real-time financial insights, automated expense tracking, and straightforward payment management, you are able to keep an eye on cash flow, discover inefficiencies, and make more informed financial decisions.Start establishing smarter financial habits with Cheqly. Get an account for your business today.