Today’s digital economy dictates clear tendencies towards seamlessness, simplicity, and trusted interactions. Mastercard said that consumers will not need to insert a physical card, type in a password, or enter a one-time code to make an online purchase by the end of the current decade.

Looking ahead to 2025 and beyond, key payment trends include real-time payment systems, blockchain technology, digital wallets, and biometric verification.

Additionally, FIS’s Global Payment Report forecasts that digital wallets and other emerging payment trends will account for 50% of e-commerce transactions.

In this article, let’s explore the 10 payment trends in 2025 and how they are going to affect the various industries.

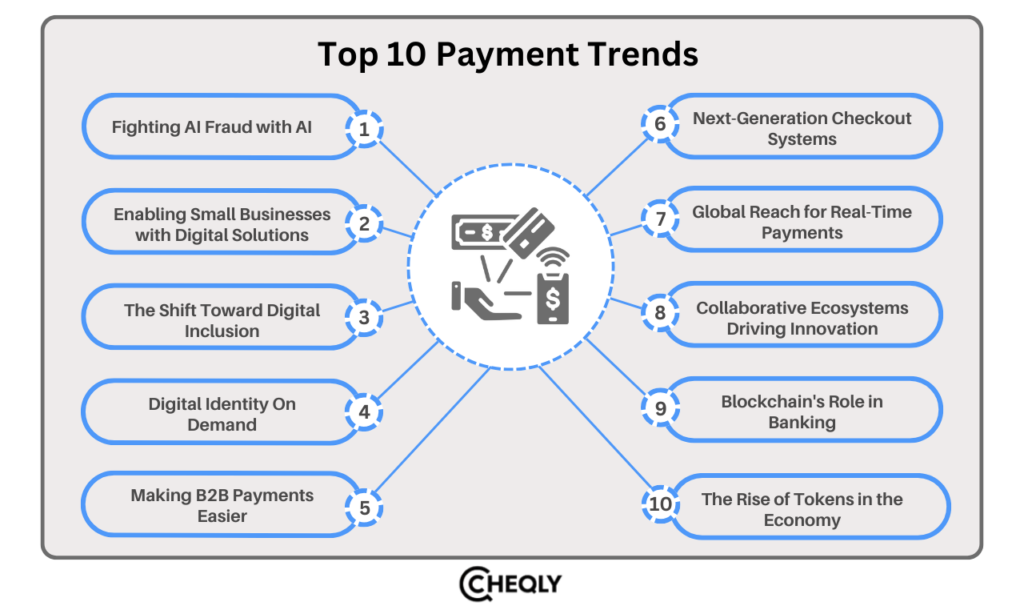

Top 10 Payment Trends for 2025 and Beyond

Have a look at how payment trends will evolve in 2025 and beyond:

1. Fighting AI Fraud with AI

Criminals are using generative AI to create personalized phishing messages and deep-fake videos in order to steal data or money. Nevertheless, individuals employed in the financial services sector must also use this weapon as a tool.

However, companies will design AI-driven fraud prevention tools to predict and neutralize hazards in real time next year. Additionally, generative AI must be employed to scan trillions of data points in order to determine the likelihood of a transaction being genuine within milliseconds. This has the potential to increase fraud protection rates by up to 300%.

2. Enabling Small Businesses with Digital Solutions

One can deduce that the companies that survived the COVID-19 crisis are those that use electronic payments, e-commerce, and other digital touchpoints. Apart from a web presence, small businesses need to have access to digital tools and services that are now new to them. Small enterprises will benefit from the increased adoption of technologies that will allow them to automate administrative tasks and create personalized marketing and loyalty campaigns on central sites that will meet specific needs. This will create a base for the provision of factual information to support their decision-making.

3. The Shift Toward Digital Inclusion

Digital wallets are replacing traditional banking systems in emerging markets, thereby becoming an indispensable instrument for the unbanked.

By enabling consumers to connect their debit or credit cards to local accounts for seamless international transactions, initiatives such as MasterCard Pay Local are promoting inclusivity.

The transformation of digital wallets into comprehensive platforms that incorporate payments, loyalty programs, and even healthcare will facilitate a more widespread adoption in developing economies and generate opportunities for increased financial inclusion.

4. Digital Identity On Demand

The digital economy is now based on the ability to conduct frictionless yet secure interactions based on digital identity.

Biometrics and passkeys are currently replacing traditional passwords as users seek convenience as well as better security.

New digital identity solutions will come into the picture in healthcare, education, and government services sectors by 2025 to allow users to share their identification clearance selectively.

Europe, particularly, is leading in this charge, given that there are companies offering new services that add a layer of convenience to identity verification and, hence, better security and privacy.

5. Making B2B Payments Easier

The earlier changes in B2B payments in a conventional, gradual fashion are now accelerating. Virtual cards, embedded payments, and real-time reconciliation are enabling organizations to manage spending, mitigate fraud, and deliver operational efficiency.

Loyalty programs and cart integration are just a few areas where embedded finance platforms, which are expected to reach $124bn by 2025, will revolutionize how SMEs manage their finances.

The gradual shift from physical to digital B2B payments will eventually enable the eradication of more standard errors; it will also create more fluid and efficient environments for businesses of various forms and sizes.

6. Next-Generation Checkout Systems

According to the survey, more than two-thirds of in-store purchases are made through contactless payment methods. New layers of capabilities, such as Tap on Phone, are liberating acceptance by turning mobile devices into terminals for large, medium, and small-scale businesses.

Apart from regular payment mechanisms, responsive innovations are possible, such as establishing contactless payments through instant cards, e-wallets, or transaction checks.

Such developments will ensure that the digital and physical retail interfaces deepen to offer a smooth and efficient payment process.

7. Global Reach for Real-Time Payments

Experience claims that by 2028, real-time payment systems will be worth 27 percent of the global electronic payment systems, as real-time payment systems currently exist in over a hundred countries.

Domestic schemes are beginning to support cross-border transactions in real-time payments, which are growing worldwide.

The combination of government-backed CBDCs with other real-time payment systems will further enhance international trade, where traditional and other advanced and innovative digital sectors will continue to interact smoothly.

8. Collaborative Ecosystems Driving Innovation

Innovation is contingent upon partnerships in an interconnected world. Banks, fintech firms, and governments are, therefore, evolving from tactical partnerships to ventures that empower them to develop value-added solutions.

Embedded technologies and collaborative ecosystems are bringing together financial tools in an integrated, accessible manner, expanding the benefits of the digital economy to underserved areas, creating trust and inclusivity.

9. Blockchain’s Role in Banking

The transformative potential of blockchain technology for global commerce is being demonstrated as it matures. In the field of B2B and commercial payments, cryptocurrencies, stable coins, and other tokens and assets are gradually taking their place based on their effectiveness, security, and speed.

When traditional banks team up with blockchain-based companies, they’ll help speed up the adoption of blockchain. This means faster and safer payment solutions, and it will also make a big impact on trade finance and supply chain management.

10. The Rise of Tokens in the Economy

Tokenization is the foundation of the payments industry’s goal to eradicate manual card entry by 2030; however, its applications extend far beyond card payments.

Underlying assets or tokenized assets, which can be made possible through the use of blockchain technology, will be the new face of economic activity, such as the trade of carbon credits and land titles, as well as capital markets.

From an e-commerce perspective, tokenization will enable consumers to share their preference information with merchants safely and help open up personalized offers without any risk to the consumer’s data privacy.

There is great potential for the development of ways businesses and consumers will interact in this digital age through the use of this technology.

In conclusion, the payments landscape and its trends in 2025 will be distinguished by advanced security, seamless experiences, and greater inclusivity. AI will secure transactions, real-time payments will connect economies worldwide, and blockchain will improve efficiency in various industries.

With the expansion of digital wallets into comprehensive platforms and the blossoming of collaborative ecosystems, businesses and consumers will experience a new level of flexibility and access. The emergence of these tendencies means that we are witnessing a fascinating period of change. The payments industry will continue to be at the forefront in the delivery of innovative and progressive solutions and the key player in the development of a transformative new economy.

Transform the way you bank with Cheqly!

Handling your business money has never been simpler. Cheqly assists small businesses in simplifying solutions such as ACH and wire transfer capabilities and safe payment mechanisms. With Cheqly, you can separate your personal and business expenses, streamline payments, and gain better control over your cash flow—all from one intuitive platform.

Sign up for a Cheqly account today and experience smarter, seamless banking tailored to your business needs!