Business leaders today have a lot of information about the economy, customers, and their operations. But in a world dominated by data, simply having access is not enough. Companies need to use that data to assess their performance and make decisions accordingly. Business studies reveal that companies that regularly monitor their KPIs have a 46% higher chance of achieving their goals.

Transparent operational metrics highlight areas of strength and identify those requiring attention. This article covers both metrics and KPIs and lists eight essential ones that characterize a successful business over time.

What are Operational Metrics?

Operational metrics can serve as indicators for businesses to measure and track their performance within a certain time period.

Usually, these indicators provide company executives, along with other decision makers, with information about their core operations, showing the efficiency or productivity of the organization.

Operational metrics are different because they assign a numerical value to a business operation or process, making it possible to track and analyze performance. For instance, a company may track its revenue over time to obtain an objective analysis of its growth.

What are KPIs?

Key performance indicators (KPIs) are strategic, high-level metrics that are frequently monitored in real time and provide an overview of the business’s profitability, effectiveness, and market positioning at any given moment.

KPIs provide insight into progress toward a company’s strategic objectives. In other words, they reveal how well the company’s overall strategy is performing.

This way, a business can start tracking the number of sales calls a sales rep makes each week and what percentage of those calls lead to sales in an effort to increase the sales outreach effectiveness.

Importance of Tracking Operational Metrics

KPIs and operational indicators are both crucial in corporate leaders’ decision-making process.

Initially, by keeping track of these metrics, companies are able to gauge their performance in a clear and unbiased way, pinpointing the areas where they are doing well or those that need to be improved.

Besides, it helps a company pinpoint its production blockades and inefficiencies. By monitoring the operational metrics and KPIs, a company will immediately find the areas where the performance is below the standard and will be able to react quickly to the problem.

A business may examine its KPIs more closely if it observes declining sales from quarter to quarter and discovers that the number of sales calls has decreased significantly between the two periods.

They can use this information to meet with the sales team and develop new goals and objectives to stop the trend in the near future.

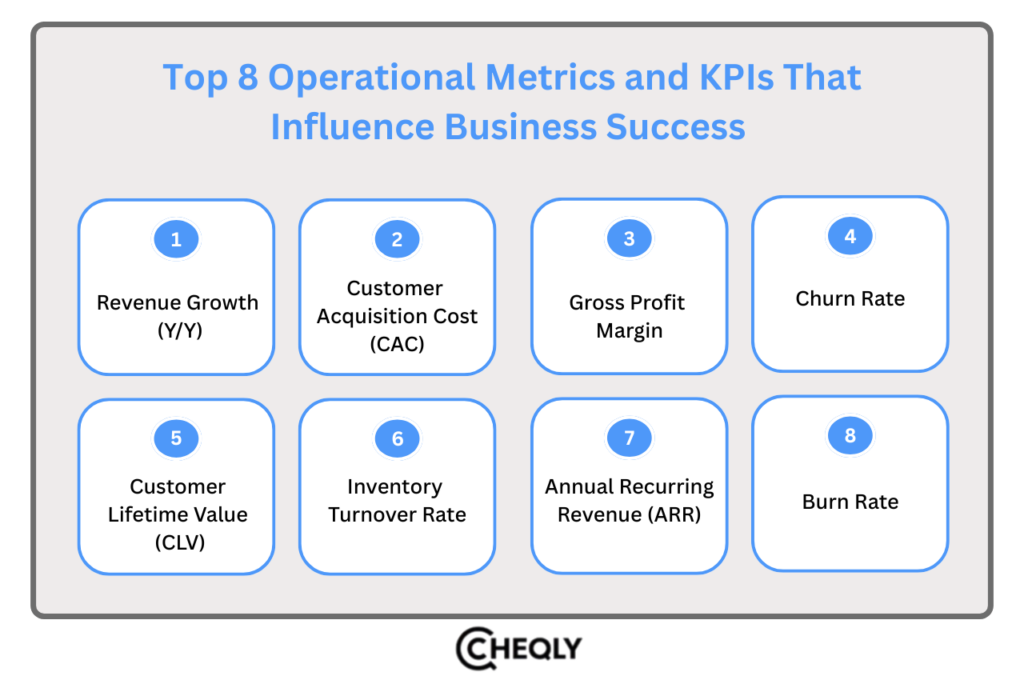

Top 8 Operational Metrics and KPIs That Influence Business Success

We can now identify the key values that businesses should monitor to support their expansion since we have a better grasp of what operational metrics and KPIs are and the significant role they play.

Although these can provide you with a solid foundation to track your company’s success, keep in mind that this is by no means an exhaustive list of all the operational indicators or KPIs that are available.

Furthermore, some of these measures might be more pertinent than others, based on the industry and strategy of the company.

Revenue Growth (Y/Y)

Tracking revenue growth on a yearly basis is one of the essential metrics that indicate the overall health of your company, and it discloses whether sales continue to rise year after year.

Located prominently at the top of the income statement, this indicator is frequently referred to by stakeholders, investors, and leadership.

Department: Finance

Formula: [(Sales this year – Sales last year) / Sales last year] * 100

Customer Acquisition Cost (CAC)

For marketers, tracking the customer acquisition cost (CAC) is crucial. It indicates the total amount a company pays to get a new customer and is a very effective tool for assessing sales and marketing performance.

Keeping track of CAC regularly makes sure that the increase in the number of customers is always sustainable and profitable.

Department: Sales/Marketing

Formula: Sum of Sales and Marketing Expenses / Number of new customers acquired

Gross Profit Margin

One of the most typically monitored measures by finance departments is gross margin, which is frequently of interest to stakeholders and investors in the company. It is presented as a percentage of sales or as a separate gross profit figure on the income statement, where an increase in the margin suggests better efficiency and a decline in the margin may point to higher costs or difficulties in setting prices.

Department: Finance

Formula: (Revenue – Cost of Goods Sold) / Revenue

Churn Rate

The percentage of consumers you lost during a specific time period is known as the customer churn rate, which is also frequently called customer attrition, customer turnover, or client churn.

This metric is crucial for SaaS and subscription-based companies as it has a direct influence on recurring revenue and the company’s long-term growth potential.

Department: Sales/Marketing

Formula: (Number of Churned Customers / Total Customers at the Beginning of the Period) * 100

Customer Lifetime Value (CLV)

The customer lifetime value (CLV) is closely associated with Customer Acquisition Cost (CAC). This measure will assist you in determining the overall gross profit a client will bring in for your company over time.

Customer retention period, average revenue per account (ARPA), gross margin, and revenue churn are some of the factors that influence CLV.

Department: Sales/Marketing

Formula: (ARPA * Gross Margin) / Revenue Churn

Inventory Turnover Rate

Inventory turnover rate, or the rate at which the business turns over its inventory in relation to its COGS over a specific time period, is another measure that is relevant to leadership. This aids in assessing how well a company uses its resources, especially in the retail or e-commerce industries.

Low ratios result from having too much inventory or from poor sales. High ratios indicate that sales are strong, but there may be a problem with stock shortage.

Seasonality and costs can distort it, so retailers need to watch it closely when making decisions about pricing, ordering, warehousing, and promotions.

Department: Manufacturing/Operations

Formula: COGS / average value of inventory

Annual Recurring Revenue (ARR)

Monitoring their annual recurring revenue (ARR), or the amount of predictable money earned by customers each year, may also be very beneficial for business leaders. Although it is measured over a longer period of time, this is comparable to monthly recurring revenue (MRR).

Much like churn rate, ARR is mainly significant to subscription-based businesses since these customers’ subscriptions provide a regular, steady revenue stream. Monitoring ARR over time serves as a good means to help ensure that the revenue is stable and to plan for the company’s operations and growth to be sustainable.

Department: Sales/Marketing

Formula: (average monthly revenue per customer * total number of customers) * 12

Burn Rate

The company’s cash burn rate reveals whether the company is spending more than it is earning, and it also helps in calculating the cash runway. A high burn rate is a sign of overspending, while a low rate is an indication of financial stability.

Leadership and finance teams should keep an eye on it so that they can plan for sustainable growth.

Department: Finance

Formula: Cash payments – cash collections

In conclusion, consistently monitoring operational metrics and KPIs allows you to stay aware of how your business is performing and make data-backed decisions. The exact metrics you track may differ based on your sector and goals, and they can always be adjusted over time.

FAQs: Operational Metrics & KPIs

Here are quick answers to common questions about operational metrics and KPIs, and how they help business performance.

How frequently should KPIs be reviewed?

Depending on the metric, KPIs should be regularly reviewed. Operational KPIs such as churn rate and revenue trends may be reviewed weekly, whereas strategic KPIs are generally reviewed monthly or quarterly.

How to align KPIs with business strategy?

Directly align KPIs with strategic objectives, for example, by connecting CAC and CLV to growth targets. Involving teams in KPI selection helps ensure ownership and keeps the metrics relevant to them.

How to select the right KPIs?

When choosing the KPIs, pick about 5-10 such metrics that highlight the features of the industry you are in (e.g., inventory turnover for retail) and make sure that they are specific, measurable, achievable, relevant, and time-bound.

How do operational KPIs affect team productivity?

Operational KPIs reveal inefficiencies, for example, a low number of sales calls limiting revenue growth, thus giving the sales team a cause to organize training sessions or look for process improvements to increase their productivity.

Can operational metrics reduce costs?

Yes, keeping an eye on gross profit margin and COGS will help you spot waste, and at the same time, if you optimize inventory turnover, you will free up capital that is unnecessarily tied up in inventory.

What are the leading indicators of operational risk?

An increase in the churn rate, a decrease in ARR, or a faster burn rate are clear signs of risk and can be avoided by planning the cash runway ahead of time.

How to handle underperforming KPIs?

For underperforming KPIs, you should discover the root causes, decide on targeted measures, and keep track of progress to get better results.

Better Visibility Into Your Business Finances with Cheqly

Cheqly offers digital business accounts with online account opening, debit cards, payment solutions and financial tools. Manage your cash flow, make your operations more efficient, and get a complete view of your business performance.

Start using a Cheqly business account and make your business finances work for you.