Nowadays, international wire transfers have become important for business and personal transactions in the global marketplace. Every day, transactions worth several trillion dollars occur across the globe, facilitating global trade, investments, and personal remittances. However, due to the involvement of numerous banks and complex payment systems, tracking an international wire transfer is not always easy.

Innovations like SWIFT’s Global Payments Innovation (gpi) have revolutionized the way people make international payments by enabling them to follow their international payments nearly in real-time. Due to the UETR code being carried in the message, such as the MT103, customers have an increased level of transparency and security.

In this guide, we’ll walk you through how to track international payments, what details you’ll need, how long international transfers take, why internal wire transfer delays occur, and what steps to take if your funds haven’t arrived.

Ways to track an international wire transfer

Tracking is very important if the sender and the receiver want to be sure of the success of the international wire transfer. A very easy and fast method to track an international wire transfer is to adhere to these simple steps:

- Collect all relevant transaction details: Gather all of the necessary details regarding the wire transfer including the date of transfer, transaction reference number as well as the names of the sender and the recipient.

- Reach out to your bank or payment service provider: Contact your bank’s customer service or go to the closest branch in person (if available) with the transaction details. Ask them to help you locate the wire transfer. They will be able to access the required systems and get the information that they need to assist you.

- Use online banking tools to check the status: If you have access to online banking, then you can log into your account and locate the wire transfer section. A few banks may provide you with tracking updates for your international wire transfers, but keep in mind that the detail level may vary from one bank to another.

- Communicate with the sender for updates: If you are the recipient, get in touch with the sender to make sure they have provided the correct information and initiated the wire transfer the right way. Ask the sender to provide any tracking or reference numbers their bank may have given them.

- Track the payment using the SWIFT system: Banks conduct international transfers using the SWIFT network. Most of them also participate in SWIFT gpi, a system that ensures faster, transparent, and traceable transactions. The UETR associated with the MT103 allows you to track your transfer. Check with your bank to see if SWIFT gpi tracking is available.

If you keep in touch with your bank and track your transfer at every stage by following these simple steps, you will be able to solve any problem and ensure that your international wire transfer reaches its destination.

What information is required to trace an international payment?

To trace an international payment, you need the following information:

- Name of the sender

- Name of the recipient

- Transaction reference or confirmation number,

- Date of the payment

- Amount transferred

Details like the recipient’s bank name, address, and account number—as well as the sender’s bank name, federal reference number, and location—can be really helpful.

You can use this information to contact your bank’s support team or check the payment status through online banking.

How much time does an international wire transfer usually take?

There are many different variables that can impact the duration of international wire transfers. Normally, international wire transfers require between 1 to 5 business days for their completion. The main factors that will impact the timeline are: the countries where the banks are located, banks that are used as intermediaries, security and compliance procedures that are in place, as well as any possible disruptions due to weekends, holidays, or time zone differences.

Besides, the transfer time may also be influenced by various elements, including the need for currency exchange, additional compliance checks, and errors or lacking information for the recipient. Your bank or financial institution can provide you with a more accurate estimate that takes into account your individual transfer needs.

What should you do if the recipient hasn’t received the funds?

If the recipient hasn’t received the funds, several steps can be taken:

First and foremost, it is absolutely necessary to make sure that the wire transfer was done properly and that the correct recipient details were used. Contact the sender to confirm the information given is correct and to get any tracking or reference numbers related to the transfer that will help you locate the transaction.

Next, contact your bank or another financial institution and inform them of the situation. They can investigate the transfer, verify its status, and identify any issues or delays. It is also recommended that you provide any information or documents that are related to the wire transfer in order to facilitate the inquiry.

To be certain that the transfer was done correctly, you could also speak with the sender’s bank to get information about the transfer from their side. By quickly involving all the parties—the sender, the recipient, and the relevant banks—it becomes easier to identify any errors or issues and decide together on the best way to proceed so that the recipient receives the money.

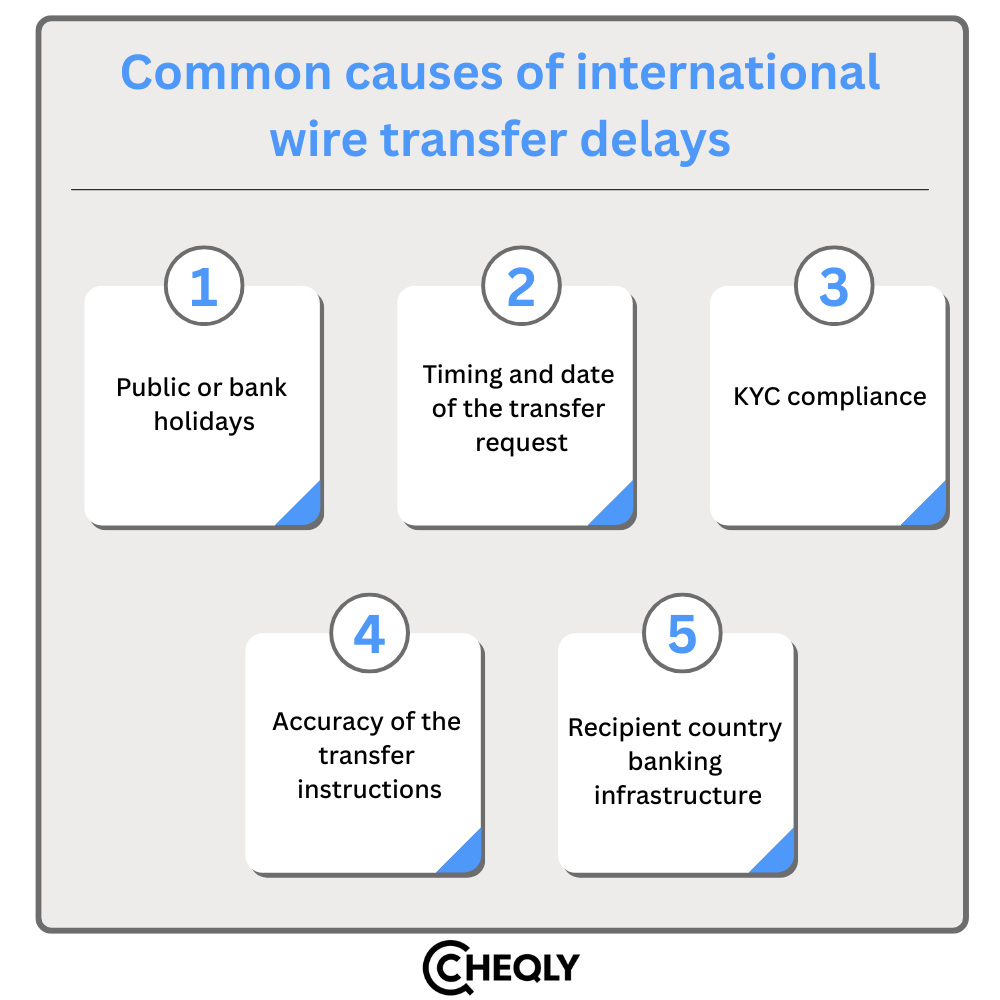

What causes delays in international wire transfers?

Delays in wire transfers can be caused by a number of things. By being aware of these variables, one may better control expectations and take the required actions to reduce delays.

- Public or bank holidays: Processing can be delayed by local bank holidays in the sending or receiving country. It’s best to look at the holiday calendar first before arranging your transfer.

- Timing and date of the transfer request: Banks have specific hours called cut-off times. If you miss them, your transfer could be delayed by a day or even longer, particularly if it is near a weekend or a holiday in any of the countries.

- Compliance with Know Your Customer (KYC) regulations: To ensure that legal requirements are met, banks and other financial institutions carry out stringent compliance and security checks. If additional proof or paperwork is required, these checks may occasionally cause delays.

- Accuracy of the transfer instructions: Mistakes or incomplete information—such as misspelled names, incorrect account numbers, or missing addresses—can slow down or halt the transfer while the correct details are verified.

- Banking systems and infrastructure in the recipient’s country: A wire transfer’s speed is affected by the receiver bank’s system and the destination country’s financial infrastructure. Certain areas may have banking networks that are not well-developed or that operate at a slower pace, which could result in a delay of the funds.

Being aware of these factors enables you to establish sensible expectations and confirms that you have provided all necessary documents and information, thus lessening the likelihood of delays that could have been prevented.

FAQs on Tracking International Wire Transfers

The following are some frequently asked questions on tracking international wire transfers.

What is an MT103, and why is it important?

An MT103 is a standardized SWIFT message that proves a wire transfer has been initiated. It acts as a digital receipt and contains all transaction bank details, making it the main document banks use to trace and verify international payments.

Can currency conversion cause delays?

Yes, definitely if currency conversion is involved—particularly for the currencies that are not so common—it might lead to a delay of one or more days in the transfer.

Is there a deadline to start tracing a transfer?

Yes, many banks require you to request a trace or recall within a certain time frame after sending. If too much time passes, recovery may be impossible.

What does “in transit” mean for wire transfers?

“In transit” means the payment has been sent but not yet received, due to it being processed, awaiting compliance, or stuck between banking systems.

What if the transfer is stuck with an intermediary bank?

Your bank can use the SWIFT network to contact intermediary banks and identify where the transfer is held up. This may, however, be time-consuming, but the MT103 or tracking number can help you get the tracking status of the transfer.

Can I trace a wire transfer without an MT103?

While the MT103 is the main reference for tracing, you can sometimes trace using other details like the transaction reference number or Federal Reference number, but the process may be slower and less precise.

Can banks charge a fee for tracing a transfer?

Many banks charge a fee—sometimes steep—for tracing or recalling a wire transfer. Charges range from $15 to $50 or more; confirm with your bank before proceeding.

Is it safe to share my MT103 with the recipient?

Sharing the MT103 with the receiver is generally safe, but since it contains sensitive bank details, you should only share it through secure channels with trusted parties.

Experience Smooth International Transactions with Cheqly

Cheqly has made cross-border payments easy, which are generally a nightmare for small businesses to handle. It enables you to send international wire transfers at an affordable cost and makes it easy to pay foreign vendors or track overseas expenses. Low fees, clear pricing, and a secure platform result in quicker, more reliable, and less complicated transfers abroad.

Open a Cheqly business account and enjoy smooth international transfers.