Contactless payments have reshaped the way Americans pay for everyday goods and services. What started as a convenient option has now become a major force driving change across retail, banking, and consumer behavior. In 2025, the payment market is growing faster than ever, creating exciting opportunities for innovation. At the same time, it brings big challenges, especially around security and system integration, as millions of people in the US tap, wave, or scan to pay every single day.

This article explains the rise of contactless payments in the United States, the factors responsible for this trend, and the possible implications for the future of the financial sector.

What are Contactless Payments?

Contactless payments make it easy to pay without swiping your card, inserting it, or using cash. You simply tap your card, phone, or smartwatch near a compatible payment terminal, and the transaction goes through securely.

Tap-to-pay cards and mobile wallets (such as Apple Pay, Google Pay, and Samsung Pay) are among the most popular contactless payment methods.

The major benefits of contactless payments are faster checkout, increased security due to encrypted data transfer, and improved hygiene—a feature that has become more important nowadays as people are more conscious about their health and lead faster-paced lives.

US Market Growth & Consumer Adoption

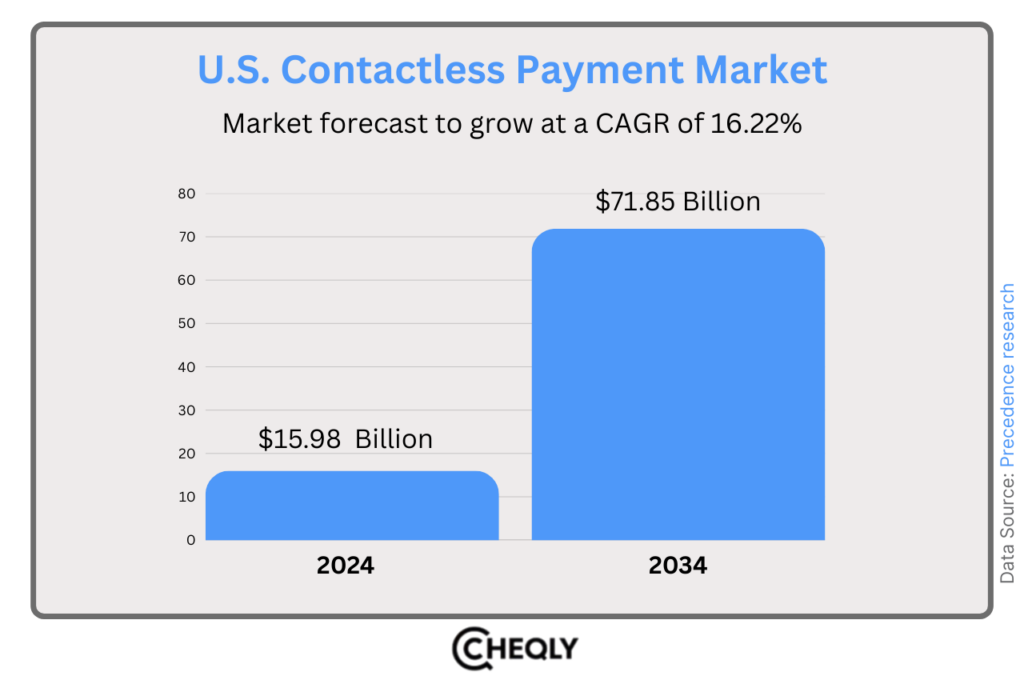

Contactless payments are reshaping how people pay across the US. The market was worth about $15.98 billion in 2024 and is set to grow rapidly, reaching nearly $71.85 billion by 2034, with an annual growth rate of around 16% between 2025 and 2034. North America, with the US at the forefront, was responsible for 47% of the global contactless payment market in 2024, thus showcasing the region’s critical role in setting the trend for the global market.

Widescale usage is fueled by the deployment of tap-to-pay cards, mobile wallets, and the rapid modernization of point-of-sale infrastructure throughout retail, transit, and service sectors. The COVID-19 crisis has expedited this direction of travel, as both consumers and merchants have been looking for ways to transact safely without issues of cross-contamination.

Currently, almost 90% of US consumers have used contactless payment methods, and more than 60% of in-store transactions are projected to be contactless by 2025. Retailers and financial institutions are continuously investing in contactless technology, which is a growth engine and a leading factor for expansion and deeper penetration.

Consumer Behavior and Preferences

Americans are embracing contactless payments more than ever. Young adults started the trend, but now it’s common to see people of all ages tapping their cards or phones, especially in stores and transit systems.

Despite the fact that 51% of Americans who conduct digital transactions express concerns about security and privacy, customers’ trust in these technologies has been renewed by biometric authentication and tokenization. Almost 77% of people believe contactless payments are safe, and for some, they feel even more secure than using cash or cards. With better security and user education in place, more people are jumping on board.

Top US Contactless Payment Trends for 2025

Contactless payments are growing fast in the US, and 2025 is bringing new ways for people to pay.

1. NFC Technology Enabling Smartphone POS

Near Field Communication (NFC) tech, which works with most tap-to-pay systems in the US, has played a big role in the rise of contactless payments. Visa’s Tap to Phone, growing 200% globally each year, shows just how much people are embracing easy, digital-first ways to pay.

For small businesses, it’s a huge win, letting them accept payments through their phones with just an app, no extra hardware required. A considerable percentage, nearly 30%, of Tap to Phone users are new small businesses, indicating that this innovation strongly supports those who want to get onboard quickly with contactless payments.

“30% of Tap to Phone users are newly launched small business”

– VISA

2. Mobile Wallets Driving Contactless Adoption

Mobile wallets are now leading the way in contactless payments across the US and have become a big driver behind the move to digital transactions. The market is expected to grow from $349.66 billion this year to $3.85 trillion by 2035, showing just how fast digital payments are taking off.

“By 2035, the mobile wallet market is expected to grow to $3.85 trillion”

– Future Market Insights

3. Biometrics are Making Payments Safer

Contactless payments are getting easier and more secure thanks to biometrics like fingerprints and face recognition. In the Americas, more than 75% of people are already using this tech, which shows just how comfortable they are with it. By 2025, over 1.4 billion people around the world are expected to use face recognition to pay. As biometrics become more common, paying without touching anything is becoming faster, safer, and more convenient for everyone.

“Over 75% of Americans have utilized biometric technologies like fingerprint scanning and face recognition”

– Coolest Gadgets

4. QR Code Payments on the Rise

In the United States, people are increasingly using QR code payments, which they likely use at least once a month. This trend is particularly noticeable among small businesses, where QR codes offer a straightforward and efficient way to manage payments.

They’re easy to use, cost-effective—since they don’t need special equipment—and faster too. A Forbes report says nearly 99.5 million Americans are expected to use QR codes, showing just how much people are leaning toward flexible, touch-free ways to pay.

“By 2025, an estimated 99.5 million people in the U.S. will be using QR codes”

– Forbes

5. Voice-Based Payments: The Next Wave

The voice payments trend is picking up pace rapidly in the US. The global market for voice payments is valued at $11.5 billion in 2024 and is forecasted to reach $28.9 billion by the year 2033. Virtual assistants and the ease of going hands-free are the main reasons for the increase.

“The global market for voice payments is valued at $11.5 billion in 2024 and is forecasted to reach $28.9 billion by 2033”

– Global Growth Insights

6. The Growth of Wearable Payments

Wearable payments are still the fastest-growing part of contactless payments. Experts say the US market could jump from $13.4 billion in 2024 to $65.87 billion by 2030, thanks to the steady rise of mobile payments and NFC tech. Smartwatches are driving this trend because they’re easy to use and fit right into people’s daily routines.

“United States Wearable Payments Devices Market Projected to Reach $65.87 Billion by 2030”

– Globe News Wire

7. AI-Powered Fraud Prevention

The application of artificial intelligence to contactless payments is transforming the way fraud is prevented, as it can be detected and blocked in real-time.

Mastercard’s Decision Intelligence Pro system, based on AI, can process up to 1 trillion data points to verify the legitimacy of payments in less than 50 milliseconds, improving fraud detection by an average of 20% and up to 300% in some cases. This technology minimizes false rejections and improves the security and trustworthiness of contactless transactions in 2025.

“Mastercard’s AI system boosts fraud detection by up to 300%, securing contactless payments in 2025”

– Mastercard

Top US States for Contactless Payment Adoption in 2025

Some states are ahead of the curve when it comes to adopting contactless payments, driven by local businesses and what consumers want. In this section, we’ll take a look at the regions leading the way in 2025.

- Florida: Florida’s tourism and hospitality industries, which are very robust, are also leading the way for contactless payments. Miami and Orlando are at the forefront of upgrades to the digital POS systems for fast and secure transactions.

- California: San Francisco and Los Angeles are major cities in California that are at the forefront of using contactless payments, especially in retail, dining, and tech, aiming to increase efficiency and meet consumer demand.

- New York: New York City has become a global center for contactless payments, which are now extensively used for managing large sums of money, assisting tourists, and enabling tap-to-pay transit, all of which have contributed to a thriving business environment.

- Texas: The diverse economy of Texas and thriving tech hubs like Austin, Dallas, and Houston are quickly fueling the use of new contactless payment systems in the state.

- Illinois: Businesses in Chicago, ranging from retail to transportation, have been integrating contactless payments and modern POS systems to become more efficient and better satisfy their customers.

- Nevada: Las Vegas’s hospitality and gaming industries are behind Nevada’s leading position in the contactless payments market, which focuses on speed, hygiene, and convenience.

- Arizona: Businesses in Phoenix have a reputation for being highly accepting of contactless and cryptocurrency payments, which not only reflects a positive image but also satisfies the customers who are tech-savvy.

If you are starting a new business or thinking about moving your existing one to any of these states, you can get help from IncParadise, a trusted partner of Cheqly, with the setup and compliance process.

Business Opportunities

Contactless payments are opening new avenues for business in the US. Here are some of the main ways in which they are fueling growth and innovation:

- Customer Attraction and Retention: Two-thirds of consumers are likely to switch to merchants offering contactless options, making it a key differentiator.

- Operational Efficiency: Business productivity and customer satisfaction have been positively impacted by faster checkouts and less cash handling.

- Data-Driven Personalization: Digital transactions generate valuable data, enabling tailored marketing and loyalty programs.

- Expansion Across Sectors: Besides retail, industries such as transportation, hospitality, and healthcare are also adopting contactless technologies to make their customer journeys more efficient.

Challenges and Considerations

In spite of the definite advantages of contactless payments, companies have to overcome some problems, which should promote their successful implementation and use by a great number of people.

- Privacy and Security Concerns: The best way to ease consumer concerns about data collection and cybersecurity is through clear education and strong security measures.

- Digital Divide: Making sure people with limited digital skills have the same opportunities is still a big challenge.

- Infrastructure Gaps: There are certain businesses that experience problems when they try to renovate their old systems to enable them to use contactless payments.

Future Outlook of US Contactless Payment

Contactless payments, already very popular in the US, are expected to spread even further beyond 2025. In addition to retail, these payments will also be used in transit, hospitality, and healthcare. Advances in biometrics, AI-powered fraud detection, and wearables are making payments faster and more secure. Along with strong consumer trust and supportive regulations, contactless payments help businesses run smoothly and support financial inclusion. Still, ongoing investment in security, infrastructure, and digital skills is important to make sure everyone can benefit.

Manage Your Business Card Payments Seamlessly with Cheqly

Cheqly’s card payments are designed to offer comfort and strong security. This means that you are able to complete transactions quickly and securely, without physically presenting the card, either by using a virtual debit card for online purchases or by adding your card to popular digital wallets like Apple Pay, Google Pay, and Samsung Pay for use in physical stores.

Cheqly enables fast and secure transactions with its advanced security features, while also making it easy to monitor your expenses accurately through real-time financial insights.

Get started with your Cheqly business account and manage card payments easily.