Have you noticed the nine-digit code at the bottom of the checks? You may have misunderstood it as an account number, but this is an ABA routing number, also known as a bank routing number. This signifies the financial institution that pays the check.

What is an ABA number?

An ABA number, a nine-digit code identifying banks in the United States, is also called a bank routing number. Using an ABA number, banks transfer money from one customer to another via wire transfers, direct deposits, and automatic bill payments.

How do ABA numbers function?

Your bank account and ABA numbers can help you provide all the necessary information to process your payments. After you have provided the numbers to the payment processor, you do not need to provide any further information.

If your bank undergoes a merger, you may receive a new ABA number for signing up for banking services. However, in many cases, the ABA routing number gets transferred.

Until you order new checks or sign up for new services, find out if you can keep using the previous numbers from your bank.

ABA numbers adhere to a complex system:

It’s Behind the Name

Like an address, an ABA number directs financial institutions to your account. For this reason, ABA numbers are sometimes referred to as check routing numbers or routing transit numbers (RTNs).

Readable on Computer

Usually, magnetic ink is used to print routing numbers on checks, making it easier for specialized equipment to read the code. Regardless of the presence of magnetic ink, printers typically use the MICR font, which makes it simple for computers to recognize the numbers visually. This is useful if you take a picture of a check with your phone and deposit it.

You can see that the first four digits represent the Federal Reserve Routing Symbol. Depending on their series, the first two digits have distinct meanings. Each series is described in detail on the ABA website.

The ABA institution’s identifying digits are the following four numbers; the ninth digit represents the checksum. The first eight digits of this complex mathematical expression are used. The transaction becomes invalid if it is sent for manual processing and if the final result differs from the checksum number.

What do the ABA digits signify?

Let’s have a look at understanding the ABA number formats, how they are assigned, and what they signify:

| Part | Purpose |

|---|---|

| First four digits | These shows the bank’s location. Nonetheless, banks have moved towards mergers, so the number for location does not make sense anymore. |

| Fifth and six digits | These tell you which Federal Reserve Bank manages the institution’s electronic and wire transfers. |

| Seventh digit | This indicates the check processing center for the Federal Reserve Bank assigned to the bank. |

| Eight digit | This points out the location of the Federal Reserve District. |

| Ninth digit | This represents the checksum of the ABA number. You can find this number by adding the sum of the first eight digits. |

What is the use of an ABA number?

The ABA number helps identify the bank where the recipient has an account. Also, ABA numbers are utilized to send money domestically.

Who can utilize ABA numbers?

A bank must be a state or federally-chartered financial institution qualified to open a Federal Reserve Bank account to receive an ABA number.

Money transfer services, bank consumers, and financial institutions (such as credit unions and banks) all use ABA numbers, including bank routing numbers.

If you have a question on how to find my ABA number, then we have shared two ways to do it:

Where can you find the ABA number on a check?

You can find an ABA number for your account in many places. If you have a checkbook handy, the simplest way to find the numbers is to look at the bottom of one of your checks. Now, let’s know where the ABA number is on a check.

The check has an ABA number printed on the personal check, the nine-digit number in the lower left corner. Computer-generated checks (such as business checks or checks for online bill payment) may have the number printed elsewhere.

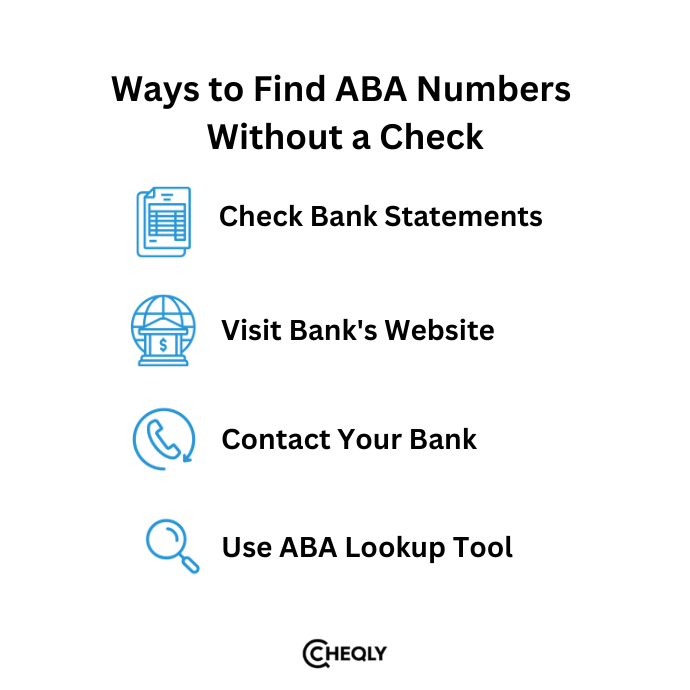

How to Find Your ABA Numbers without a Check

Every check in a consumer’s checkbook should include their ABA number. However, if a consumer doesn’t have a check for whatever reason, there are other means for them to find the routing number they’ll need to transfer money. Let’s explore how to find the ABA number without using a check:

Bank Statement

Your account number appears at the top of the right column of a bank statement. You can use your account number’s third and fourth digits to find your routing number.

Use the Bank’s Website

You can log in to your account using your bank’s website and find your ABA number. Determining the ABA number corresponding to your account is critical, as your bank may utilize multiple ones. Depending on where you opened your account, your ABA number might be slightly different. Additionally, bank mergers may result in multiple codes for the same bank. In addition, some banks have different ABA numbers for wire transfers than ACH or direct deposit transactions.

Even if you know the correct number for ordering checks, you may need to use a different number for wire transfers or electronic bill payments. When in doubt, find out which number to call from a customer service agent at your bank.

Contact Your Bank

You might call your bank to find the correct ABA routing number. If you have a traditional bank account, you can also visit a local branch, while online bank customers may need to call.

ABA Online Lookup Tool

In fact, the ABA offers a free lookup tool for ABA routing numbers, making it easy for anyone to locate routing numbers for banks. This tool is limited, meaning that a user is only allowed to use it to look up two ABA numbers in one day and not exceed ten numbers within one month. Also, keep in mind that some banks have different numbers for different states, as well as for different transactions.

When to Use an ABA Number

Although it is unlikely that you will require your ABA routing number daily, you will probably need to input it for several frequent transactions, including:

- Direct deposits made via ACH: Upon starting a new job, an individual will probably be required to furnish their bank account number and ABA number to initiate direct deposits through ACH.

- Transfers via wire: This entails using wire transfers, which are particularly popular for cross-border transactions, to send or receive money.

- Direct deposits to the IRS: The IRS offers the option to have tax refunds sent to direct deposit recipients. Accepting a direct deposit can expedite the reimbursement procedure.

- Bill payments: You’ll need your routing number to use mobile payment apps or sign up for online bill payments.

- Depositing funds into your retirement account or moving funds to a different bank: Setting up ACH transfers for transactions involving retirement savings or money transfers between banks, which call for your bank routing number, may be necessary.

Is ABA number the same as a routing number?

It is both a yes and a no. Banks use a nine-digit code to identify financial institutions when transacting with them; this is the routing number. An ABA, on the other hand, is used to identify financial institutions only within the United States, with a few additional eligibility conditions.

US Federal or State Chartered Financial Institutions that can hold an account at a Federal Reserve Bank are identified by the ABA number.

Are the ABA and SWIFT codes the same?

Although both SWIFT and ABA are used to identify where the recipient holds an account, the ABA only identifies the domestic ones, while the SWIFT code is used when you transact internationally.

How are the wire transfers & ABA different?

The ABA numbers are nine-digit codes that identify banks for deposits and cheque processing, domestically. Wire transfers are for both international and domestic transfers of funds between banks electronically. The domestic ones use ABA routing numbers while the international ones require IBAN & BIC codes. Wire Transfers are quick but can incur transaction fees.

What is the wire transfer ABA Number?

The number is a nine-digit code, just like the ABA number found on cheques. It may be the same as the number found on the cheques, but some banks use different routing numbers for different payments. So, the wire transfer ABA number is different from the one you use for ACH transfers. It is advisable to check with the bank directly to ensure you have the right ABA routing number for wire transfers.

Open a Business Account Today for Seamless Financial Transactions with Cheqly!

Opening a Cheqly account today means embracing the future of financial management. It’s not just about making transactions—it’s about enjoying a seamless, secure, and convenient experience right at your fingertips. Cheqly is your gateway to efficient, hassle-free money management tailored for modern businesses. Don’t miss out—create your Cheqly account today and see how simple and smart handling your business finances can be.