Your vision is our mission

Our mission is to support founders from idea to IPO. Already today, we administer over $50 billion in assets for thousands of founders and we process billions in clients asset valuations monthly, with other services including incorporations, valuations, compliance, and much more.

“Securing funding is undeniably challenging, and each fundraising round often comes with substantial dilution. At Cheqly, our mission is to assist you in obtaining additional capital, enabling you to continue building your vision while preserving as much equity as possible.”

– Tomas Milar, Founder & CEO

Who is it for?

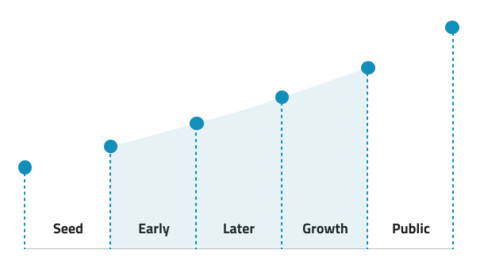

Ideal for founders who are scaling rapidly and need capital for their revenue growth and next milestones, and who pay attention to dilution.

Your Questions, Answered

Why venture debt

Venture debt provides additional capital without diluting ownership, useful for extending operational runway or funding specific growth initiatives.

What is venture debt

It’s a form of debt financing typically for venture-backed startups, significantly less dilutive than equity financing.

How venture debt works

Venture debt complements your equity financing, offering capital against future growth milestones.

What is the process

Debt is provided against applications including your past and future financials, your growth plans, and once approved the repayment schedules usually span 24-48 months.

Types of companies, requirements

Ideal for companies who raised or are raising venture capital to fuel their revenue growth, from early to growth stages.

Refinancing

While venture debt can be a one-time event, companies may opt for refinancing or taking additional debt as they grow. Our goal is to support you in the long term.

Cheqly is a financial technology company, not a bank. Deposits held at Evolve Bank & Trust are insured up to $250,000 per depositor, per account ownership category, by the FDIC. FDIC insurance protects against the failure of an FDIC-insured depository institution. Certain conditions must be satisfied for pass-through deposit insurance coverage to apply.