To make the business successful in the long run, liquidity management is the most critical skill for a business owner. Liquidity shows the important difference between simple money generation and having the right amount of cash available at the right time. Managing short-term liquidity needs with proper planning allows businesses to stay steady and weather uncertainty.

Here, we’ll break down effective steps for liquidity management and control inventory for long-term success.

What is Liquidity Management?

Liquidity management is the strategic and proactive process of ensuring that a business has enough cash or easily accessible liquid assets to meet its short-term financial obligations as they become due. It’s about making sure money is properly managed so operations continue, financial crises are avoided, and the business can grow.

Why is liquidity management important?

Management with a poor cash flow can undermine even the most successful business models. While long-term profitability is key, the short-term availability of cash is what determines day-to-day viability and long-term success.

- Supporting seamless business operations: Liquidity (being sufficiently stocked with cash) guarantees that a company will be able to meet the payroll on time, acquire necessary products, and pay the landlord without any problems. Uninterrupted cash inflow maintains the everyday business operating routine without any hitches, which in turn makes the company effective. Such dependability forms a solid base for the continuity of stable and productive operations.

- Preventing financial difficulties: The absence of cash flow is one of the biggest reasons why small businesses collapse. Good cash flow can be a kind of shield in times of crisis. Companies that handle their money with wisdom are able to avoid financial charges, keep their suppliers happy, and have a reserve for unexpected debts or short cash situations.

- Enhancing credibility and trustworthiness: A business that consistently meets its financial commitments earns trust from employees, suppliers, lenders, and investors. That trust and creditworthiness open the door to better deals, stronger partnerships, and long-term goodwill in the market.

- Unlocking investment and growth opportunities: Businesses with a good amount of cash reserves can access an opportunity in no time. A company with available cash can move fast to start a new venture, buy new equipment, or enter the target market without having to take out a loan at a high rate.

- Preserving financial flexibility: Cash on hand gives a business the freedom to spend or invest its money as needed. For example, they can buy in bulk to save money or take advantage of limited-time opportunities to stay stable and keep on track with long-term goals, even when the market is unpredictable.

- Boosting investor confidence: Investors and lenders look at a company’s liquidity as a key indicator of the business’s stability. A positive cash position shows that a company is well-managed and offers a safer bet. It is much easier to raise funds or attract new partners when the time is right.

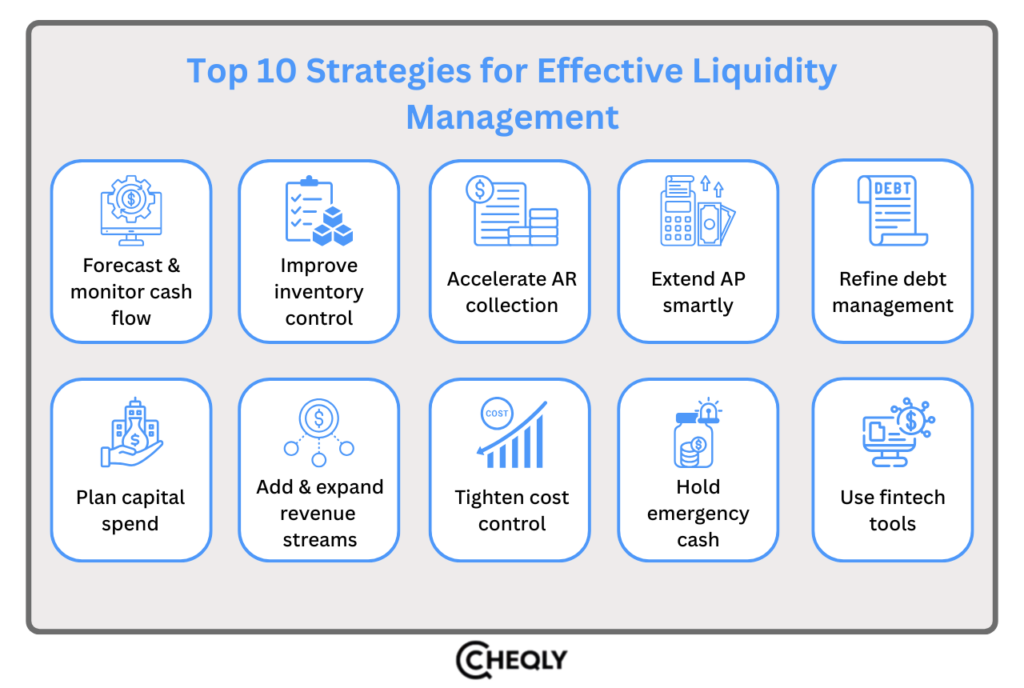

Top 10 Strategies for Effective Liquidity Management

For a robust liquidity management plan, the financial supervision needs to be proactive. The following are ten actionable strategies to increase liquidity and ensure the survival of a business.

Forecast and monitor cash flow

Effective liquidity management starts with understanding where your money is coming from and where it’s going. Management should monitor it regularly to make smarter decisions and avoid unexpected financial surprises.

Improve inventory control

Excess inventory ties up cash that could otherwise be used for operations or growth. On the other hand, running too lean on inventory risks stockouts and lost sales. Effective inventory control frees up extra cash, reduces waste, and ensures that working capital is used wisely.

Accelerate accounts receivable collection

When customers delay their payments, the company’s cash flow can be affected in a very short time.

One way to get the payment in time is for businesses to be rigorous in their credit policies, initiate the billing process on time and offer a small incentive for those who pay in advance. Incorporating automated reminders and convenient payment options will certainly facilitate customers to pay at the given time.

Strategically extend accounts payable

Paying bills well in advance can dry up your cash reserves, and on the other hand, if you pay your suppliers too late, you run the risk of damaging your relationships with them.

Besides negotiating good terms, companies can retain more cash by using the entire payment window without compromising their reputation. Using smart timing will help you coordinate the money going out with the money coming in and enhance your liquidity.

Refine debt management

Debt can be a good source to allow the business to expand, but if the business is mismanaged, then the debt can choke the cash flow.

It is necessary for companies to go over their liabilities on a regular basis, find out whether there are any refinancing opportunities that will give them a lower interest rate, and be sure that their debt payments coincide with their cash flow cycles.

Plan and manage capital expenditures

Buying expensive items like machinery, technology, or infrastructure can reduce a business’s available cash.

With proper scheduling, these expenses can be carefully prioritized according to urgency and necessity, and non-urgent investments can be deferred or financed to avoid straining cash reserves.

Expand and diversify revenue sources

Businesses face a cash shortage if they rely on just one product or one client, and that product fails or the client stops buying.

With diversification, such as complementary products, digital sales channels, or partnerships, companies can spread risk and create steadier inflows. Diversification helps ensure liquidity even if one source of income slows down.

Adopt strong cost-control measures

Unneeded expenditures can gradually consume the money that is available for the business.

Through more frequent budget reviews, cutting out non-essential expenses, and negotiating better prices with suppliers with whom the business has a long-term relationship, the company can keep its spending at an efficient level. Cost control that is done effectively gives the company the opportunity to use the cash in a wise manner, which in turn helps to maintain strong cash reserves.

Maintain an emergency cash buffer

Unexpected events, for instance, a rapid drop in sales, delays in payments, or a recession, may cause the company to experience cash flow problems. The possession of a crisis fund will keep the company going and operating as usual, even in times of interruptions, because it can be used to pay the required expenses.

Utilize financial technology solutions

Modern-day financial tools make it easier to track, analyze, and manage liquidity in real time. Cloud-based accounting software, AI-driven cash flow forecasting, and automated payment systems give businesses better visibility and control over their finances.

FAQs on Business Liquidity Management

Let’s break the complexity of liquidity management into simple questions to make it easier to understand. Here are the most common questions with crisp answers about liquidity management.

How is liquidity measured in a business?

Liquidity represents the ability of a business to satisfy its short-term liabilities in an easy manner. The key liquidity metrics are the current ratio, quick ratio, and cash ratio, each indicating the extent to which a company is allowed to use its assets to settle its debts.

What is an ideal liquidity ratio for a healthy business?

A current ratio between 1.5 and 2 is generally considered healthy, and a quick ratio close to 1 shows that the company is in a good position to cover current liabilities without depending on stock.

What are common causes of liquidity problems in businesses?

In effective cash flow planning, late customer payment and excessive debt are the common causes of poor liquidity.

What tools are used for liquidity management?

Organizations employ instruments such as cash flow projections, budgeting applications, accounting software, Enterprise Resource Planning (ERP) systems, bank charts, and automated payment systems for the efficient handling of their liquidity.

What are liquidity management KPIs?

The most important KPIs in liquidity management are cash conversion cycle, days sales outstanding (DSO), and operating cash flow ratio.

How often should businesses review liquidity strategies?

Liquidity strategies should be reviewed at least quarterly or more often during uncertain times.

Keep Your Cash Flow Healthy with Cheqly

Small businesses looking to stay on top of their cash flow can count on Cheqly. Its real-time view of money coming in and going out helps avoid unwanted surprises. With no monthly or annual fees, no minimum balance, and smooth integration of payments, cards, and insights, Cheqly makes it easy to keep cash flow steady and takes away the stress of running out of money.

Entrepreneurs to make informed cash flow decisions—open your Cheqly business account now.