Market conditions shift at lightning speed, and new unicorns emerge overnight. Yet, the venture capital industry remains shackled by a valuation process that belongs in the ‘70s.

Due diligence challenges best highlight the immense difficulty in identifying winners in time. While VCs can afford to spend 20 hours or more on due diligence for each possible investment, a professional business valuation takes 2 to 4 weeks.

As a result, valuable startups may go unfunded, not due to lack of merit, but because the system is too slow to respond. Thus, the startup environment suffers from inefficient distribution of funds and delayed access.

Such inefficiency stifles the technological progress that these startups could otherwise deliver.

Amid such challenges, Eqvista Real-Time Company Valuation® can be a transformative solution. Our partner’s latest technological breakthrough underscores the significant value we bring to our clients. With Eqvista, you can have access to advanced cap table management, 409A compliance, and funding round negotiation support, all alongside our trusted banking services.

Real-Time Data to Strengthen Your Funding Talks

In the startup ecosystem where all funding negotiations revolve around valuations, Eqvista’s real-time valuation software can be a valuable addition to your negotiation toolkit. It can provide data-driven insights into your startup’s value, ensuring that you do not settle for less.

One way to leverage this tool in a negotiation would be to identify favorable funding windows, as a startup’s valuation depends heavily on market conditions.

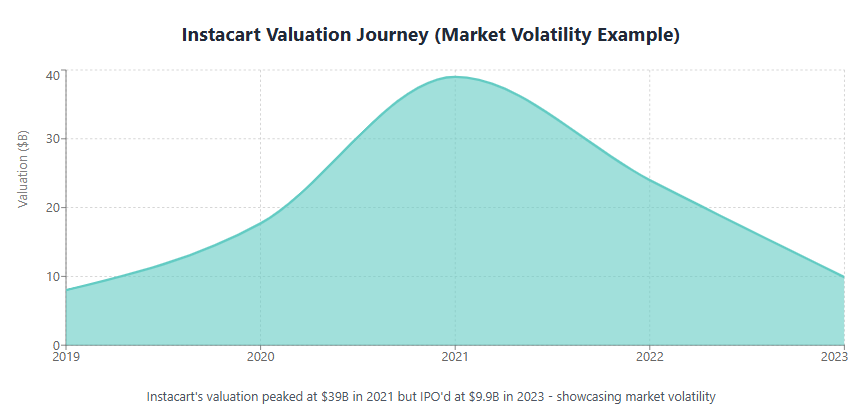

Consider the case of Instacart, a grocery delivery platform. In 2021, business was booming for the company due to the lockdowns enforced in response to the COVID-19 pandemic. As a result, its valuation reached $39 billion. However, 2 years later, the startup went public at a valuation of $9.9 billion.

With the real-time valuation software, you can accurately narrow down the window that fetches the most favorable valuation.

Furthermore, the software is capable of producing unbiased and objective valuations. This would help you avoid closing deals at inaccurate and unfavorable valuations resulting from biases prevailing in the market.

Reducing Barriers for Investors Through Better Information

A major problem in venture capital markets is the lack of liquidity. This is why venture capital funds have lengthy tenures ranging from 8 to 12 years. These challenges have only been accentuated of late with the average lifespan of VC funds extending to 13.1 years.

Such long investment periods act as barriers to entry for many. As a result, a negative feedback loop is created. Lack of liquidity discourages investors, creating a further lack of liquidity.

The primary reason for the illiquidity is the opacity of startup valuations. Certain startups prefer operating in stealth mode to avoid duplication of business models and to protect intellectual property. However, even beyond the stealth period, startups aren’t required to publish annual reports and other disclosures.

As a result, gauging a startup’s valuation is extremely challenging.

However, since this required significant time commitments from CFOs and other top executives, doing so was a distraction from mission-critical tasks until now. By leveraging the real-time valuation software, you can effectively sidestep this hurdle and allow investors to enjoy greater liquidity.

Real-Time Updates for Ownership and Stock Value – Ensuring Everyone Knows What Their Stake Is Worth

From the perspective of investors, a cap table should reflect changes in ownership as well as stake value. Most valuation software in the market do a satisfactory job of tracking ownership, vesting, and dilution. However, the reported valuations in these cap tables are often outdated.

At a startup that issues stock-based compensation, it is highly likely that the previous valuation was a 409A valuation. In the worst-case scenario, this would mean that the valuation was last determined a year ago. At startups that do not issue stock-based compensation, the previous valuation could be even more outdated.

As a result, investors suffer from a lack of up-to-date insights, complicating portfolio management.

However, on Eqvista’s platform, the stake values can be updated by simply requesting a new real-time valuation.

Valuation transparency can also enhance the value of your stock-based compensation. Most employees realize the importance of investing, and some may even know about the wealth-generation potential of venture capital. However, over time, a lack of exits can frustrate employees and affect overall morale. In such a scenario, periodically publishing valuations would reassure employees of the value of stock-based compensation and help them pursue investment exits in an informed manner.

Driving growth in venture-backed ecosystems and mid-market businesses

Eqvista Real-Time Company Valuation® is expected to transform venture capital and mid-market businesses by:

- Accelerated funding cycles – The real-time valuation software can be leveraged by investors to significantly shorten the time spent on due diligence. Once all key facts are verified, investors can simply input the data into the software to validate valuation claims and make informed decisions.

- Enhanced visibility – Startups and mid-market businesses can use the software to provide valuation updates regularly, as well as upon investor requests, without any time lag. This would empower investors to confidently make portfolio adjustments to deal with unfavorable conditions while also allowing them to react to favorable exit windows.

- Enhanced performance tracking – Real-time valuation software can be an extremely useful tool for performance tracking and interpreting the outcomes of various scenarios. Thus, the software can act as a strategic decision-making tool.

Valuation insights at your fingertips!

Eqvista Real-Time Company Valuation® is an AI-powered technology developed by seasoned professionals. It provides an unparalleled combination of AI’s agility and the reliability of humans. Through Eqvista’s platform, Cheqly’s clients can access up-to-the-minute valuations on demand, not just during annual reviews or fundraising rounds. With continuous insights into valuation drivers, you can make smarter strategic decisions that maximize your startup’s worth.

Connect with their team to begin expediting your valuations!