Financial forecasting helps small businesses check their financial health and predict what’s ahead. By looking at past data from income statements and balance sheets, businesses can see how they might perform in the future and understand their assets, debts, and profits. This allows them to make intelligent decisions like gaining or handling capital. Knowing how to calculate these financial statements will help companies understand the difficulties they will face in the short run and prepare them for a promising future.

How to Forecast Financial Statements?

A financial statement forecast is a technique through which small businesses utilize different sections of past data and use it to forecast results likely to be seen concerning the financial position of the business.

Three major financial statements, namely balance sheets, income statements, and cash flow statements, are typically produced by small enterprises. However, it should be pointed out that with the help of the analysis of the three statements, a complete assessment of the financial condition of your business is possible. An organization may forecast income statements and balance sheets. The income statement and balance sheet data can be used to generate a cash flow forecast.

What Is A Balance Sheet Forecast?

An estimate of the assets, liabilities, and equity at a future date is called a balance sheet forecast. It is used to estimate the future assets and liabilities a business expects.

Given that the balance sheet depicts a company’s financial situation at a specific moment, it makes sense that the balance sheet forecast is an effort to project a company’s financial situation under specific future conditions.

A three-statement financial model’s forecasted statements are its outputs, and the assumptions that inform the model’s modifications are its inputs. It is crucial to remember that adjustments to the income statement affect the balance sheet. Below is the three-statement financial model:

- Income Statement

- Balance Sheet

- Cash Flow

Small businesses can use balance sheet forecasting to see what they will likely own and owe at a future date. This information can be useful for making important business decisions and planning future purchases.

Leaders use financial forecasts as a road map to help them negotiate the uncertainty of their specific environments. The strategies implemented to react to anticipated market conditions and business drivers are developed using these forecasts.

An essential accounting tool for estimating how line items from the income statement and anticipated cash flow will affect the company’s future financial position is the balance sheet forecast.

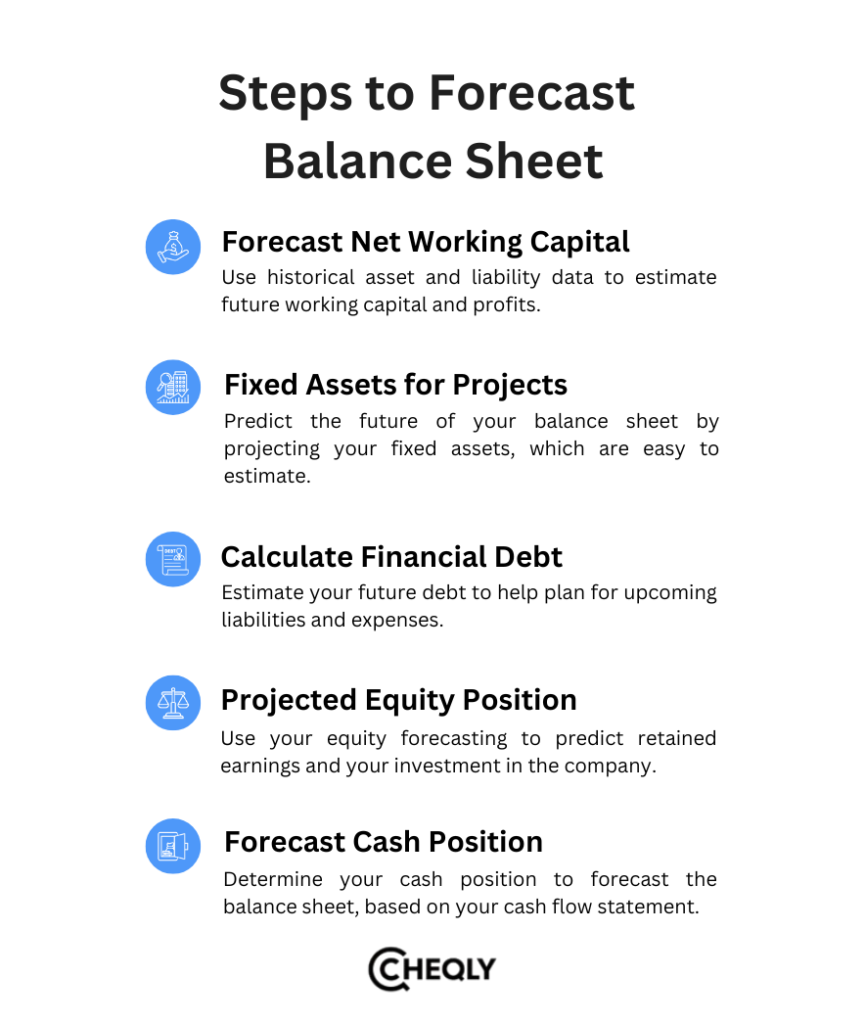

Steps to Forecast Balance Sheet

Businesses use historical data from their financial statements to forecast their future capital, assets, debt, and equity on a balance sheet. Mostly, this process uses the historical data and financial software to forecast the future condition of the balance sheet. Here’s how you can utilize financial data to forecast a balance sheet:

1. Forecasting Net Working Capital

The first step in forecasting a balance sheet is determining how much net working capital your company has. Your entire current asset and liability total is your net working capital. Examine your past asset and liability data to project your net working capital in the future. Using financial data from the previous two years is standard procedure. You can project a realistic net working capital figure for your balance sheet, forecasting profits based on your company’s historical net working capital figures and how they’ve changed over time.

2. Fixed Assets for Projects

Projecting your fixed assets is the next step in predicting a balance sheet. Your company’s fixed assets are long-term, tangible assets that are easy to project.

Depreciation must be considered for an accurate forecast of your future fixed assets. This formula can be used to project your future fixed assets:

3. Calculate Financial Debt

Projecting your debt is the next step, a simple procedure. Use the following formula to estimate the amount of debt your company will incur:

4. Projected Equity Position

Your expected equity position is the next item on your balance sheet forecast. Using equity forecasting, you can forecast retained earnings and the money you have invested in the company. The following formula can be used to predict the equity of your company:

5. Forecast Cash Position

Projecting your cash position is the last step in predicting the balance sheet. You can estimate this with the aid of your cash flow statement. The following is the cash position forecasting formula:

What is an Income Statement?

One of the three primary financial statements for a business plan income statement is the income statement forecast, also known as the profit and loss forecast. A company’s financial performance over an accounting period is displayed in the income statement forecast. It is crucial to understand that although the accounting period can be any length, it is typically one or two months.

The income statement forecast should be used by management to determine whether the company turned a profit during the given time frame. The net income at the bottom line is the crucial figure. It should also be used to compare actual results to a projection, identify trends in operating profit ratios, and create percentage relationships between expenses and revenue. Suppliers use them to gauge your company’s profitability and whether or not to grant credit.

Bank managers use the income statement forecast to inform their lending ratio calculations. For example, interest cover, calculated as earnings before interest and tax/interest paid, helps them assess if their business’s profits are high enough to cover the interest payments on their loan. Ultimately, investors use the income statement forecast to determine whether and at what price to make an investment. For instance, they will examine the income before taxes to determine their expected return on investment.

How to Forecast an Income Statement?

To project their earnings or losses for a given time frame, small businesses can create a pro forma income statement. The steps to forecasting your income statement are as follows:

1. Analyzing the Historical Data

Understanding your company’s historical performance and using that information to forecast future financial outcomes will be necessary before you can effectively project its profits or losses. Verify that the data you’re using is comparable. You should review historical data from the same period in prior years if you’re creating a pro forma income statement for a one-year period starting on January 1, 2024. It is recommended by best practices to examine historical data for at least two periods, so you should review income statements dated January 1, 2022, and January 1, 2023.

2. Forecast your Revenue

Entering your annual growth rate will simplify creating a revenue (or sales) forecast. Make an educated estimate about your future revenue by examining the percentage growth in revenue over prior periods.

3. Estimate the Cost of Goods Sold

You may not think that the cost of goods sold directly relates to your business because it is a service-based enterprise. However, service-oriented enterprises should consider their labor, employment tax, and benefit costs as part of the cost of goods sold. Alternatively, this may be referred to as the expense of services.

4. Calculate Your Operating Expenses

To ascertain your projected operating costs in your forecast, examine your historical operating expenses and contrast them with your anticipated revenue.

How to Forecast Cash Flow?

To predict your company’s future cash flow, you need to calculate the amount of money that will be coming in and going out of your firm over a given period. A pro forma cash flow statement can help you determine possible shortfalls in actual cash in the future and prepare for it earlier than during the time of deficit.

The following are the methods to forecast your cash flow statement:

- Project Your Monthly Sales: Utilize at least two years of historical sales data to determine the expected monthly sales. Ensure that you examine seasonal data to determine any patterns in your sales. Additionally, it is important to consider any future plans, such as the possibility of a significant new client joining your business in the near future.

- Forecast Payment Receipt Dates: Utilize historical data to predict the timing of future installments. If you utilize a 30-day billing cycle to invoice clients, you can anticipate the receipt of payments by analyzing the due dates. It is important to consider the fact that one of your consumers frequently pays you after the due date when making projections.

- Estimate your Cash Flow Statement: The majority of small enterprises incur both fixed and variable expenses. Rent and utilities are among the fixed expenses that must be taken into account. Your variable costs are contingent upon the volume of work you generate. Variable costs may encompass printing, postage, and travel expenses associated with business meetings for a service-based business.

Understanding Pro Forma Financial Statements

The organization constructs pro forma financial statements from projections and assumptions. Pro forma statements enable you to compare actual financial events to your financial plan and make any necessary adjustments throughout the year. Pro forma financial statements are typically generated for six months or one year by most small enterprises.

If you require a bank loan or other form of business financing, pro forma financial statements are typically necessary.

Financial Forecasting FAQs

Your business can predict its future performance by forecasting financial statements. This helps you plan and make decisions more easily. Below are answers to common questions about this important process.

Which Financial Statement is Most Important?

The income statement is usually thought of as the most important financial statement. It tells us how much a company has earned and used up in some fixed period. It conveys the main information about the financial status of the company.

How Do Businesses Maintain Accuracy in Financial Forecasts?

Businesses can take numerous steps to boost the precision of their financial forecasts:

- Use reliable data: Use accurate historical data for your forecasts.

- Regular updates: Update your forecasts regularly with new information.

- Consider outside factors: Think about market trends and the economy.

- Ask experts: Talk to financial analysts or use forecasting software.

Why is Forecasting Financial Statements Important?

Financial statement forecasting is one way a business can plan for business growth, allocate resources, get financing, and make the right decisions. Moreover, it allows companies to be proactive in solving any financial issues.

What Mistakes Should Be Avoided in Financial Forecasting?

Overestimating revenues, underestimating costs, ignoring external factors such as new competitors, and failing to update forecasts regularly are several of the common errors in financial forecasting that people make. An accurate and reliable forecast is achieved by avoiding these errors.

What are the key Limitations of Financial Statements?

While financial statements are an important tool, they are not without their flaws. Financial statements reflect past performance and cannot always provide accurate predictions of future opportunities and risks. Besides, they are built upon accounting principles that differ due to the decisions adopted by management, such as the way depreciation is calculated or the method of inventory measurement used.

A final reason is that sometimes financial statements are prepared without actual time-relevant figures and hence could be slower in the provision of data. Besides, they ignore a lot of qualitative aspects like customer satisfaction and employee turnover, which are so important for economic activities. However, financial statements have not lost their significance as indicators of the company’s performance and financial condition because of the mentioned restrictions.

How Often Should I Update My Financial Forecasts?

Financial forecasts should be updated regularly, depending on the business’s size, industry, and growth stage. Most businesses prefer quarterly updates since they align with reporting periods and help organizations efficiently gain relevant information about their performance. High-growth or volatile industries may require monthly revisions to capture dynamic changes.

Market shifts, regulatory changes, or unexpected expenses are significant events that require updates immediately. Regular updates ensure forecasts remain accurate and actionable, enabling businesses to adapt to changing conditions effectively.

What are the Challenges in Forecasting Balance Sheets and Income Statements?

Forecasting balance sheets and income statements is associated with different issues. Forecasting future revenue and expense amounts in the market is a big deal, especially in uncertain markets. Assumptions related to the future period are very difficult to handle, such as the short-term considerations of seasonality versus projecting the future.

Also, you need to carefully examine the relationship between items on a balance sheet, like receivables, inventory, and payables. Sticking to the same assumptions while considering outside factors like inflation or changes in interest rates adds another layer of complexity. These challenges show why solid data analysis and planning are crucial for making reliable forecasts.

Enhance Your Small Business Financial Planning with Cheqly!

For small business owners looking to enhance their financial planning, Cheqly offers a promising solution. Streamlining budget management, providing insightful forecasts, integrating with existing systems and being user-friendly, can significantly contribute to the financial success of a startup. Signing up for a Cheqly account could be a strategic step towards improving your startup’s financial plan, providing you with the tools and insights needed to make informed financial decisions.